As central banks race to rescue their economies from complete collapse, trillions of dollars have been pumped into the global economy at the same time. Just like the post-crisis years back in 2009, Inflationary pressures are mounting, which creates a mid-to-long-term bullish outlook for gold.

As for the recent trend, at the June meeting, Fed reiterated its previous guidance that the benchmark interest rate will remain at zero until the U.S. economy is back on track and employment recovers to its previous maximum level. Furthermore, Policy makers were examining yield-curve control strategy (YCC), which central banks in Japan and Australia have deployed to pin down longer-term rates in addition to short-term ones, signaling Fed’s intention to flat the curve and pin it to zero through 2022.

Soon after the Fed meeting, 1-Year Breakeven Inflation Rate edged up to the level above zero, expectations shifted from deflation to inflation. Higher expected inflation combined with a flatter yield curve pinned to zero, led to lower expected real rates. Remember, gold prices are driven by changes in real rates. Supported by the macroeconomic context, the gold rally began.

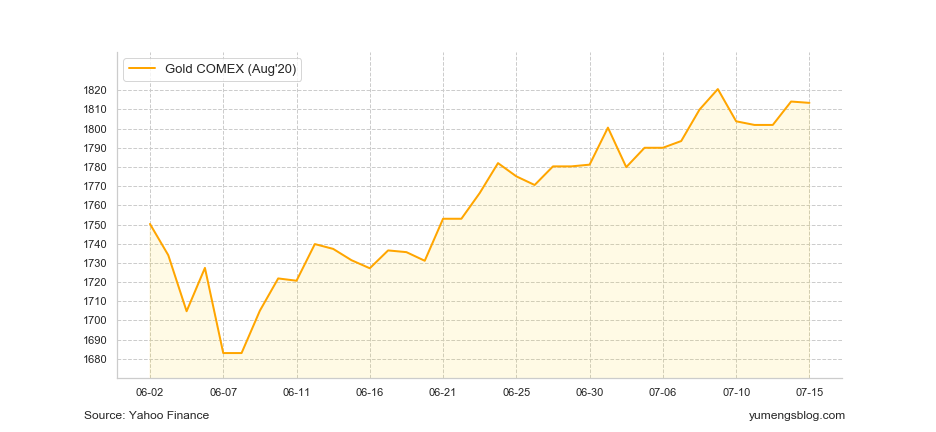

In the last four weeks, gold stormed past $1,800/oz towards its new record high in 8 years,

Certainly, the upward surge has made it more difficult to locate suitable regions for new trades, but looking at shorter-term developments, I have identified some price pullbacks on bearish economic data that proved to be good buying opportunities. In summary, the precious metal fell on short-term optimism, yet quickly rebounded on the long-term worries over inflation and global economy.

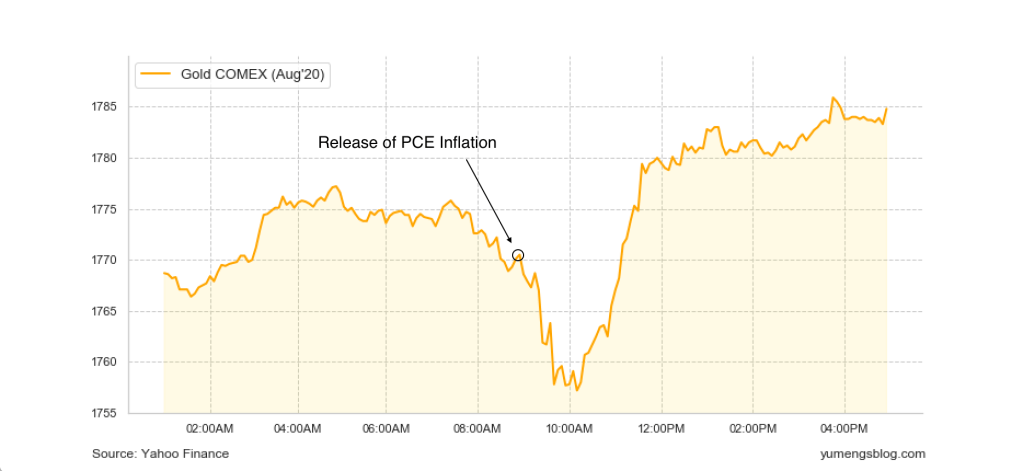

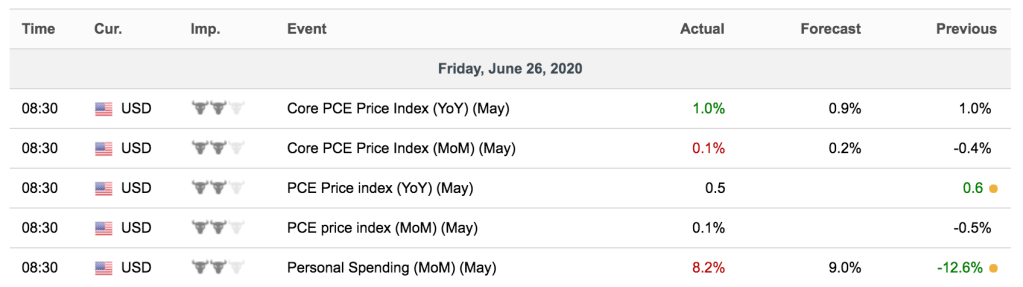

On June.26, gold future (Aug) fell sharply following the release of Core PCE and Personal Spending data for May, trading at around $1755. While from there, the price soon jumped back to $1780, forming a V-shape bounce.

The Personal Spending/Income data showed a monthly increase of 8.2% in consumer spending even as household incomes contracted, which was generally expected as of the huge stimulus package. However, this is likely unsustainable as the access to government stimulus checks will not last forever. Core PCE increased by 1%, it paints a gloomy picture that the US will see a steep drop in consumer spending and inflation remains muted over the summer months. Therefore, gold retreated to the mid-$1700 range.

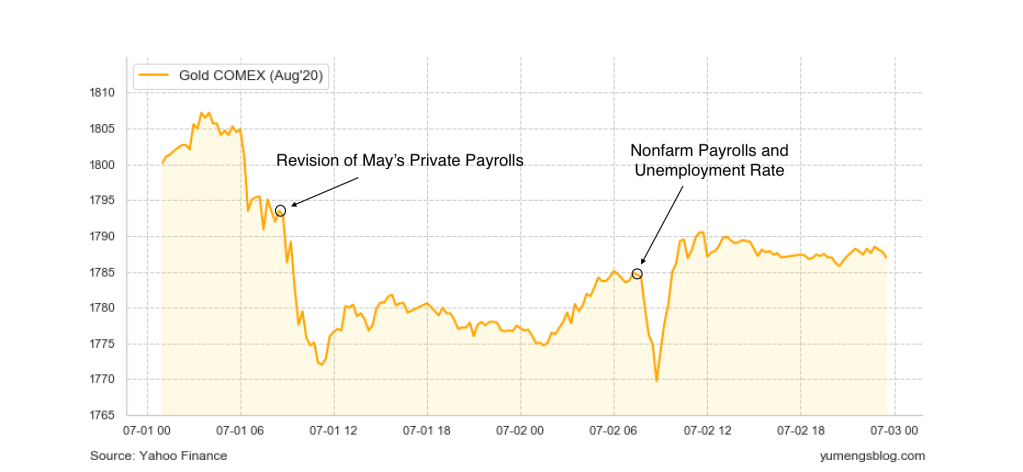

We see the V-shape bounce back again on the first two trading days of July.

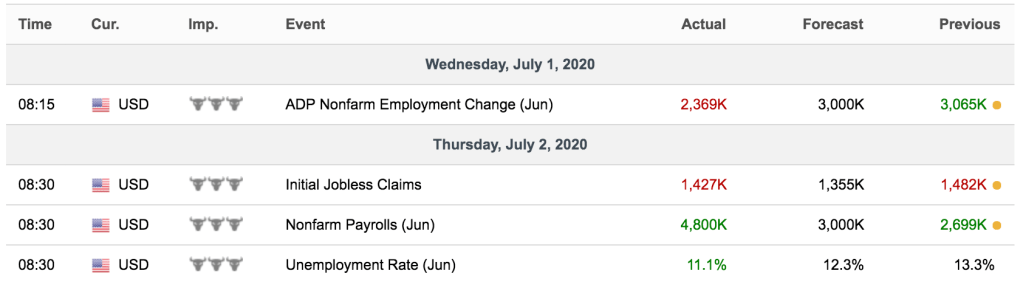

July 1, May’s ADP payroll number was revised sharply higher, going from an initially reported loss of 2.76 million to a gain of 3.065 million, which was one of the largest revisions on record according to APD. Gold prices dropped on the strong revised number, but edged up to $1780 in the afternoon.

The next day, Nonfarm Payrolls rose by 4.8 million, adding a whopping 1.8 million more jobs than expected, and the unemployment rate fell to just over 11%, also beating expectations. Optimism over job growth sent August gold future to its core support at $1770. After that, steady buying soon pushed the price back to $1790.

The movements of gold prices just proved the fact that the broad economy cannot be judged by one data point for one day. People may think the economy is coming back and that the Fed will not have to stimulate as much. While the truth is that the Fed doesn’t have a choice, the world is entering an Era of low growth, high debt, low rates and high inflation. And if you want some hedge against it in the long run, either wait for the next rise, or in the current uptrend, bet on the economic data!