Equity Valuation Concerns

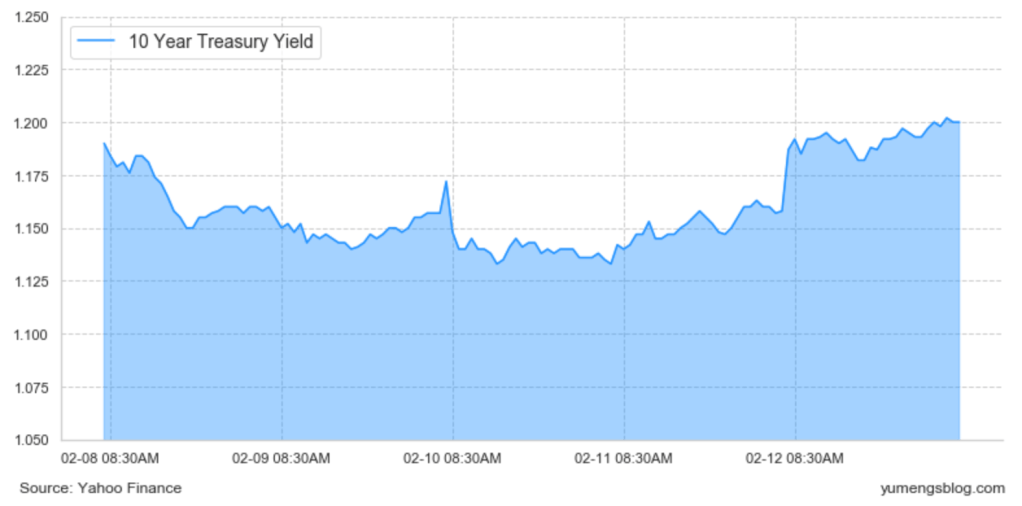

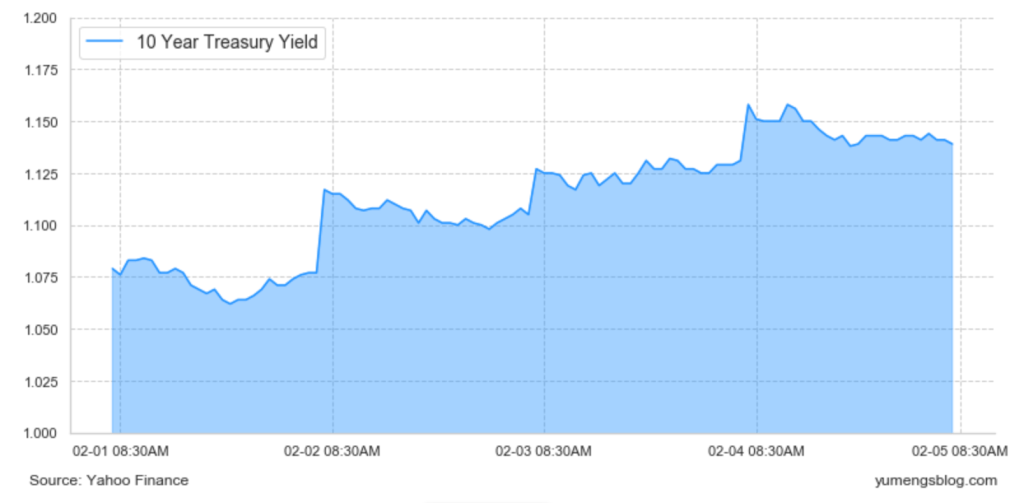

Analysts are comfortable using that twos tens got as steep as 137 basis points in December 2016 as a guide for the first target of steepening in the event that the selloff continues in Treasuries. So that puts 10-year yields at a 148 to 151 range. It goes without saying that the market loves a round numbers so 150 as a target will certainly have a fair amount of sponsorship, but before getting there, I suspect that the response of risk assets will continue to be influential in estimating just how far. this bearish price action can run. One of the key risks at this point in the cycle is that a backup in rates eventually translates through to wobbles in the equity market. We have yet to see that, but that doesn’t mean that such price action won’t ultimately occur. One of the current concerns is that we will find ourselves in a situation where 10-year yields are ranging between 130 and 145, long enough that there’s eventually a reckoning in the equity market because the move is viewed as sustainable more than just a one-off. At the moment, I would argue that what is keeping equity valuations high is the assumption that this is just a temporary spike in rates. And if it gets bad enough, the Fed will get involved.

Powell’s incentives

The eurodollar curve at this moment suggests that the market is thinking that 2023 is the year that tightening commences. For us to envision a 10 year yield above 150 or a five-year yield closer to 75 basis points, we would need to accelerate rate hike expectations. And I struggle to see an environment in which the Fed wouldn’t push back against that, because recall the Fed is actively in the process of trying to redefine investors’ understanding of the way that they’ll respond to inflation going forward. So not only will we need to see a period where inflation runs hot, but we’ll also need to see that same period accompanied by a reluctant Fed. This is the Fed’s big credibility gamble, and as we contemplate just how steep the curve can get and how far rates can back up, it’s important to keep Powell’s incentives in mind.

Now we could envision a discussion taking place about the tapering of QE, but that discussion in the public forum is very unlikely to become a reality until the very end of 2021, if not the beginning of 2022. Both the Fed and market participants remember very well the 2013 taper tantrum episode, and monetary policy officials will strive to avoid repeating that mistake. Our take is that the prospects for a true taper tantrum comparable to what we saw in 2013 are very low. First of all, the Fed certainly learned its lesson, but more importantly, the continued strides towards transparency are tangible. And so by the time the Fed makes it clear that they intend to taper, the groundwork for the decision-making will be well-established. And for that reason, I suspect that the actual tapering in this cycle will not have a dramatic impact in the Treasury Market. Said differently, by the time the Fed is willing to start the discussion on tapering, the economic data will be strong, inflation will be coming back, and the Treasury Market will have already priced in off of those macro influences the progression to the next part of the monetary policy cycle. So in essence, the Fed will allow the market to tighten financial conditions for it, and then eventually follow through with the change in monetary policy.

inflation

Retail Sales

In the week just past, the biggest economic data was a very impressive above 5% monthly gain in January for retail sales. However, it is important to keep in mind that that number was strongly influenced by stimulus checks and therefore is unlikely to be repeated in February and March, which well explains the fact that the data went almost completely ignored by the Treasury Market, supports this idea of a reluctance to push the bearishness much further even with some fundamental information in hand that would otherwise warrant higher rates.

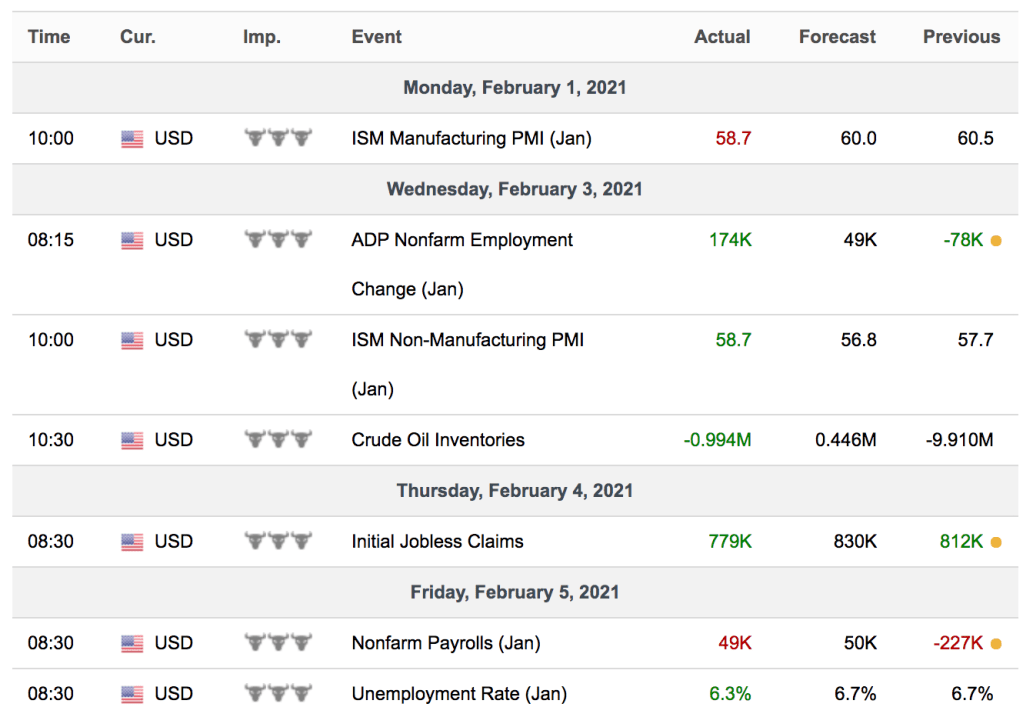

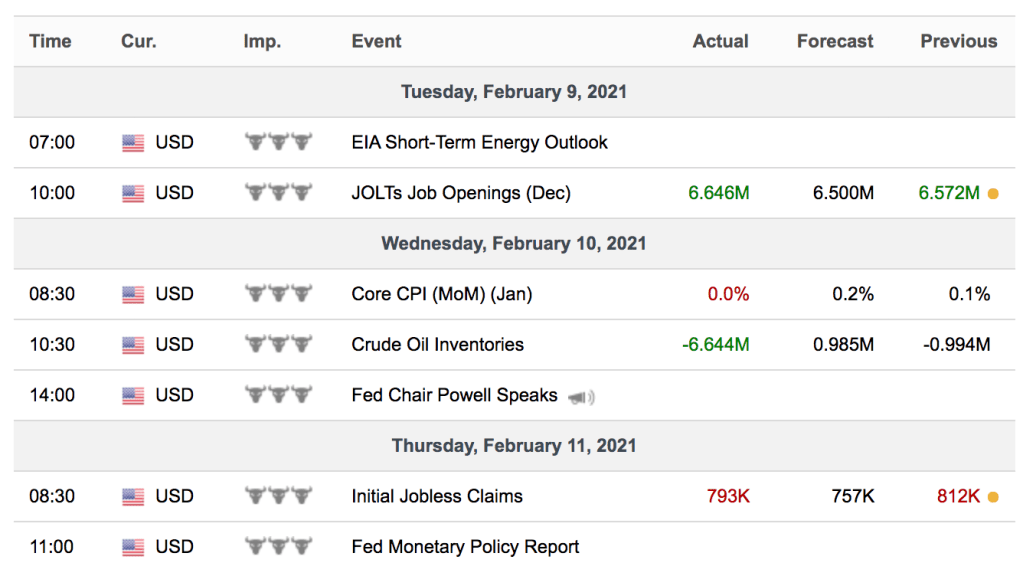

Labor Maket

This week’s jobless claims reach a four week high. There was effectively no knee-jerk market reaction, but the fact that further declines in jobless claims are increasingly difficult to envision. This stabilization and initial jobless claims North of 700,000 is not a good indication for the pace of hiring and ultimately the wage pressures that one would like to see at this point in the recovery. And the recent rise in jobless claims also reminds us of one of the core concerns which is the depressed participation rate. The number of sideline workers continues to be problematic, and it also will presumably put downward pressure on wages once we’re further into recovery and more displaced workers are brought back in.