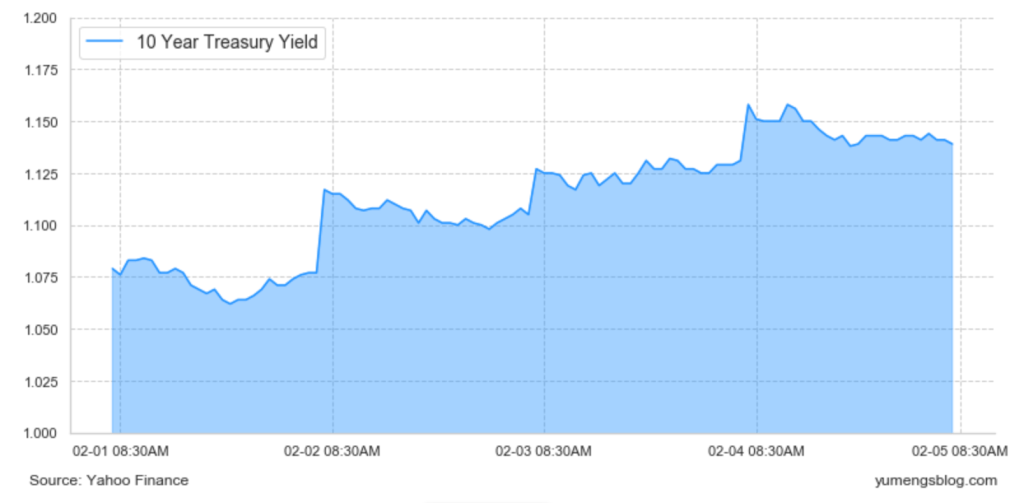

Last week, we did see the realization of the bull flattening that we were anticipating brought 10-year yields from the peak of 119 back to dip below 1%. And then we’ve transitioned to a period of stabilization and consolidation with 10-year yields between 1 and 110. For the next big move, we’re going to need to continue the process of establishing a material volume bulge above 1% before the market is content to take another shot at 125 tens. Whether that actually occurs during the first half of the year is going to be a function of the path of the pandemic, as well as how the economic data unfolds over the course of the next two months.

Reflation

Sympathetic to the underlying reluctance to reprice back to a lower rate plateau, primarily because if we look at the big trade for 2021, and that’s the reflationary trade, what we see is that continues to hold as evidenced by breakevens. We also had a higher than expected core PCE print on Thursday, which reinforced this notion that inflation will slowly start seeping back into the system, putting upward pressure on consumer prices and justifying higher rates further out the curve.

Steepeners

Selloffs are going to be steepeners, rallies are going to be flateners. So yes, we saw a decrease in long end yields below that 1% level in 10-year space, but the retracement has also left the yield curve in a meaningfully steeper territory than we’ve seen for quite some time. This is purely a function of the Fed’s influence on the front end of the curve. Stable front-end rates now are a given.

Possible Range

If we look historically, unless the market is in a moment of massive repricing comparable to what we saw in 2020 or what we saw in 2008/2009, then typically 10-year yields hold a range, on a 52 week look back basis, of somewhere between 75 and 100 basis points. If we apply that paradigm to the current trading environment, that means we could see rates above 125, 135 at some point, as well as a retracement back to that 60 to 75 basis point zone on a meaningful flight-to-quality bid that would most likely be associated with roadblocks on the drive to herd immunity.

Fiscal Stimulus

The $1.9 trillion Biden package initially proposed seemed very unlikely to go through in its current state. Expectations are that that will be scaled back to a number closer to $1.25 trillion, although what is more important is the length of the process to get there. If in fact Congress can cobble together a compromise over the course of the next four to five weeks, that is one and a quarter, that will ultimately have a more significant upside influence on risk assets as well as higher pressure on rates than if a deal ultimately takes three months to come to fruition, even if at the end of the day it’s larger in size.

Expected v.s. Realized Inflation

Currently 10-year breakevens are comfortably above 200 basis points. And as we see the drift above 211, a target of 225 doesn’t seem unreasonable given the Fed shift in its monetary policy framework, combined with all of the fiscal stimulus that’s already come out of Washington, as well as the efforts of accommodation made by the Fed. The bigger concern isn’t whether or not there’s enough fundamental justification for higher inflation expectations, but rather if those inflation expectations can be maintained while the near term realized inflation figures remain in relatively benign territory.

Update

Economic Data

Realized yield move