Review on the past week

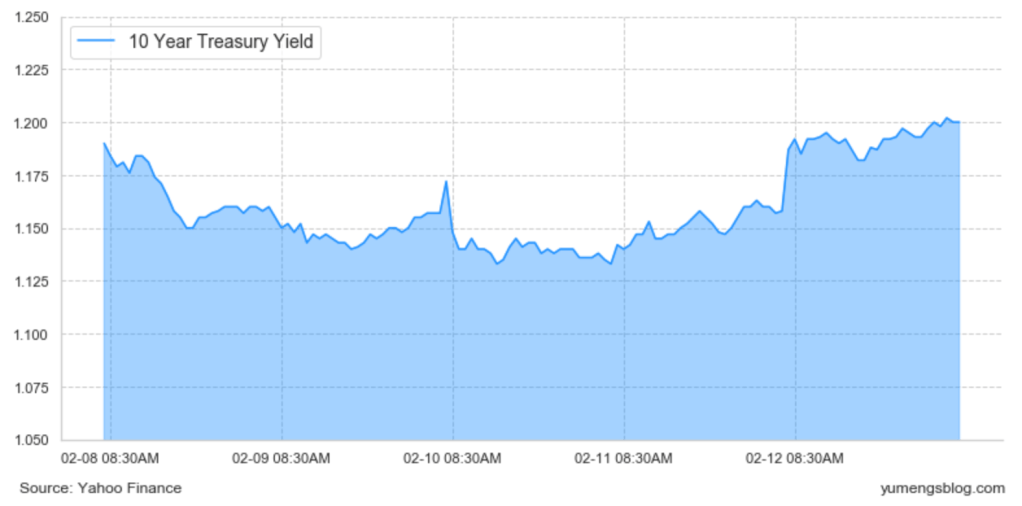

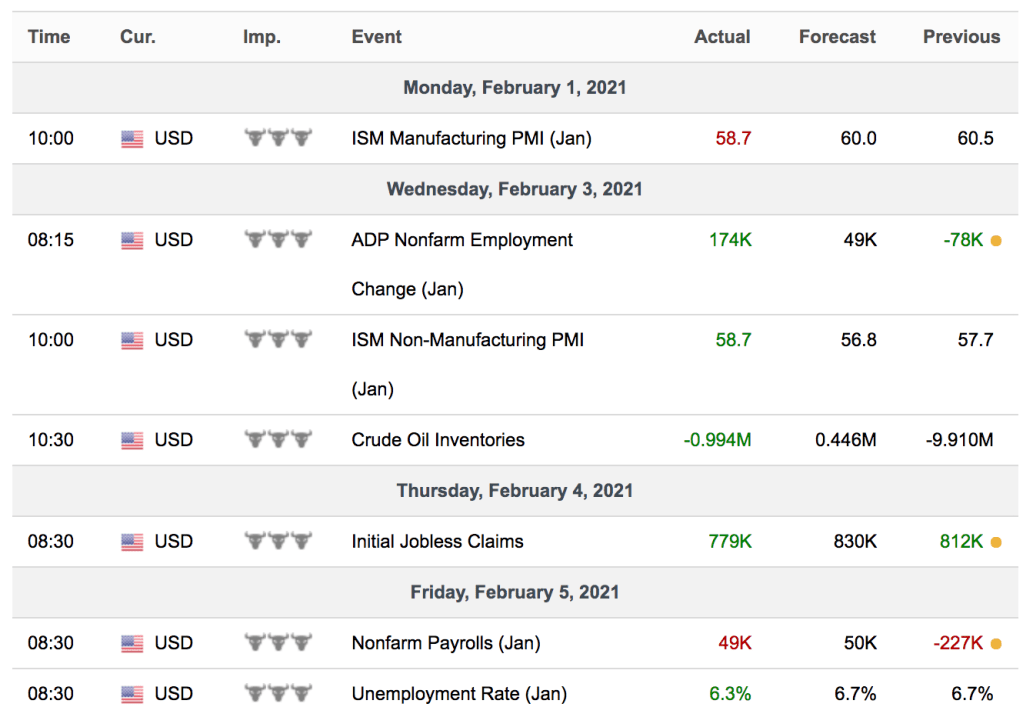

In the week just past the Treasury market had a few key inputs from a fundamental perspective to respond to in terms of pricing. On the jobs front it was a disappointing NFP print particularly within the details where we saw December revised, sharply lower, which if anything marks a relatively low departure point for the beginning of 2021 in terms of jobs growth and more importantly, the idea that the return of lockdowns is in fact having an impact on the frontline service sector and jobs creation. What was notable within the price action was we saw an intuitive bid for Treasuries on the disappointing nonfarm payrolls print, but it wasn’t able to reverse the bulk of the upside that we have seen in rates over the course of the week.

The short-lived bounce could be a reflection of next week’s refunding program with $58 billion threes, $41 billion tens and $27 billion thirties, and the disappointed job print also makes a better case for lawmakers in Washington who are attempting to push through yet another round of fiscal stimulus.

Fiscal Stimulus

This week’s survey was the fact that nobody is expecting either zero deal or a deal below $500 billion. So that does raise the bar for Congress to ultimately deliver and it speaks to this idea that there’s a reasonable amount of fiscal stimulus priced in the market at current levels.

Refunding Auctions

There will be a saturation point for Treasury issuance does remain relevant although there are key offsets that will presumably be put to test over the course of the next several auction cycles. The liquidity provided by the refunding auctions in particular is simply too enticing for big players in the Treasury market to completely ignore, so it’s safe to say that the auction process will be smooth and certainly in a traditional sense.

And on the supply front it’s worth just briefly mentioning the fact that the refunding announcement revealed coupon auction sizes are going to remain unchanged for the next quarter. Now, there was a little bit of a split consensus on whether the Treasury Department would ultimately decide to focus borrowing further out the curve, but for the time being they seemed content with the issuance profile as it is. Eventually the Treasury Department’s longer-term goal is to term debt further out and take advantage of these historically low rates. The art form behind that is to do it in such a way that doesn’t disrupt the market and subsequently lead to higher borrowing rates further out the curve.

EXPECTED V.S. REALIZED INFLATION

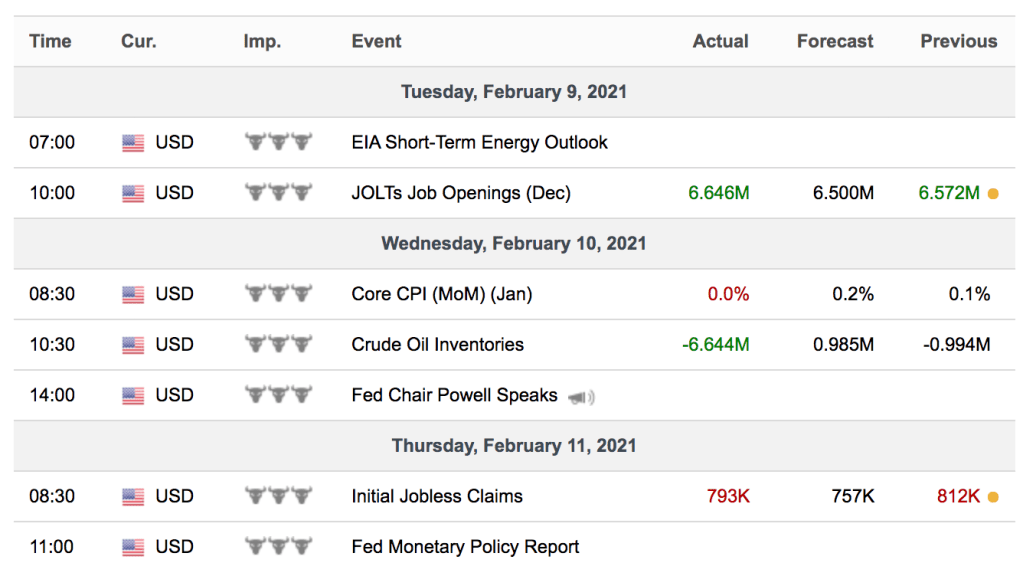

We can see sustainably higher inflation expectations as evidenced by breakevens, even if we don’t have that actually translate through to upside risk for inflation in the very near term. If we look at the consensus expectations for Wednesday’s CPI, they’re very much in line with what we tend to see for that series and do not suggest that we’ll be facing a period of upside pressure on consumer prices that the Fed doesn’t want to see.

Another facet that’s worth discussing is before we’re able to really see the true demand-driven type of inflation that the Fed is after, what ultimately will need to happen is upward pressure on wages and upward pressure on real wages that comes along with higher consumer confidence and thus a willingness to spend.

Thoughts on the New Normal

- Work remotely

- Move from high-population density areas to the first and second ring suburbs or beyond

- Drop in labor market participation as at least one parent needs to stay home to fill the gap of childcare that in-person schooling had previously provided

Next to Watch

The two touchstones that matter in that context are record high equity prices and 10-year yields that continue to drift a bit higher. I was encouraged to see the post-NFP bid that brought 10-year rates back to effectively unchanged on the day and cleared the path to trade supply. And that’s what we’re doing right now and that will be the story between 9:00 AM on Friday and Wednesday and Thursday’s refunding auctions for tens and thirties.

Update

Economic Data

Realized yield move