I wrote down some of my thoughts on the night of Nov.10th, after the Pfizer vaccine news hit the wire. With hindsight, I think it’s a fair one so I decided to post it here:

For one who is not an active trader seeking profits from short-term fluctuations, is it fair to say that gold is now officially at sell zone?

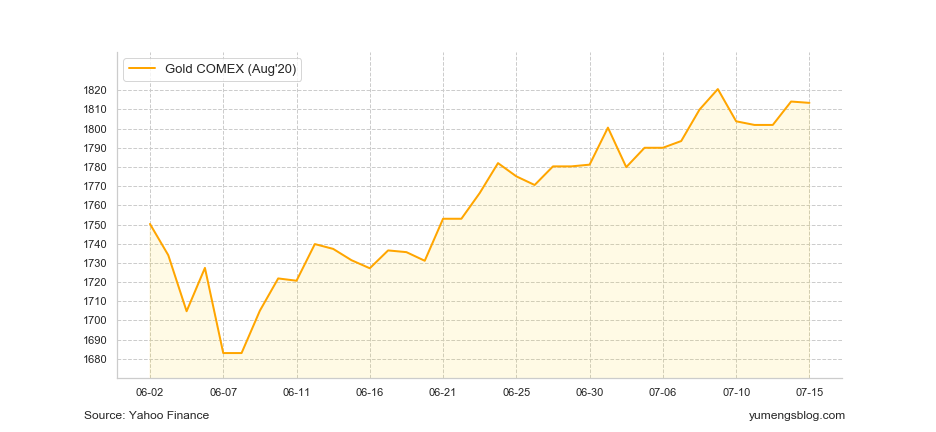

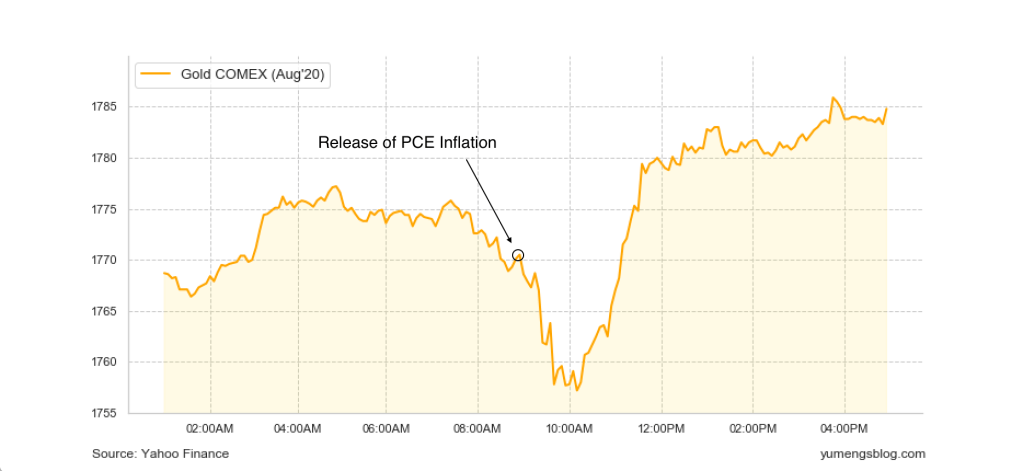

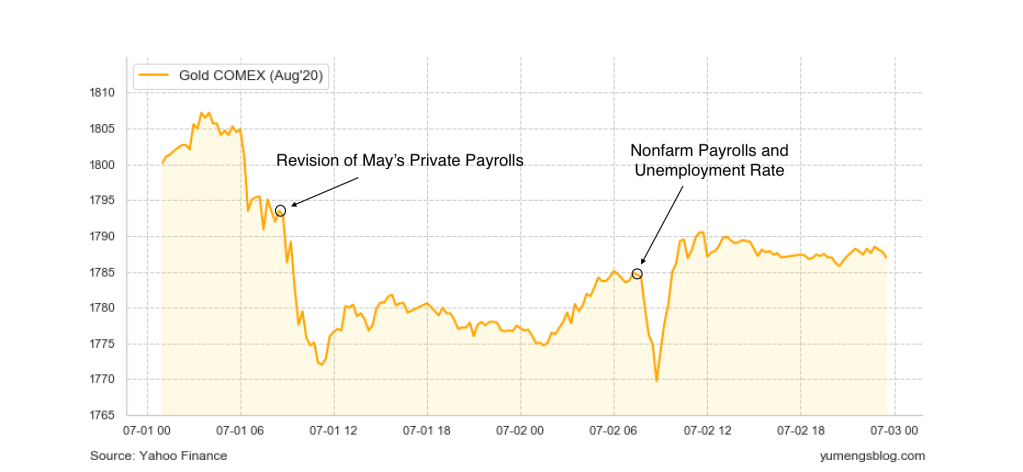

Since the peak in August, the yellow metal has been choppy and traded in a wide range (I mean really wide). One thing worth noticing is that the average trading price has moved downwards as law makers failed to deliver additional fiscal support and Fed has no more commitments. As they said, “The U.S. central bank is already doing ‘quite a lot’. The economy ‘screams out’ for more fiscal help.” Yesterday, in response to the exciting vaccine development, gold price endured the sharpest fall. Fine, took another hit.

Next, first of all, we need to understand that the vaccine news will undermine the outlook for a new stimulus deal. If a vaccine gets emergency use authorization and the distribution of it allows the economy to return to normal, that will reduce the need for another stimulus package. Mommy treats you incredibly well, buys you the toys that you couldn’t get even rolling on the floor screaming is all because you are sick. What if you get well again?

Because of the post-election uncertainty, it is unlikely to have a deal until January. While in the absence of stimulus, I am afraid good news on the vaccine will come one after another, bringing gold prices lower and lower.

In seeking the bottom of prices, there is one idea I particularly like that it’s not about how low the price is, but when a turn-around will come. Key signs/events could be inflation expectations rising, deflation expectations coming down or Fed making more commitments. So the question becomes, when will inflation expectations rise? In my opinion, that would be when a large stimulus package is on the way. At the late stage of the globalization and the Third Industrial Revolution, low growth, widening wealth inequity and growing share of service sector have muted inflation, which now just cannot simply come from the endogenous economic growth. Very sadly, our short-term hope is on the fiscal policies. The long-term hope points to innovation. Technological advances can expand the aggregate demand curve and eventually, save us all.

I look forward to space travel, sincerely.