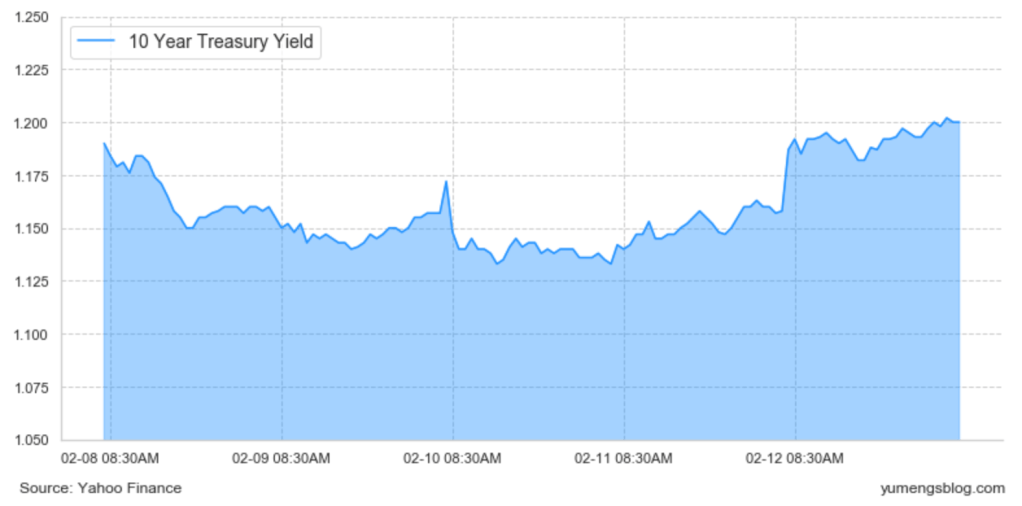

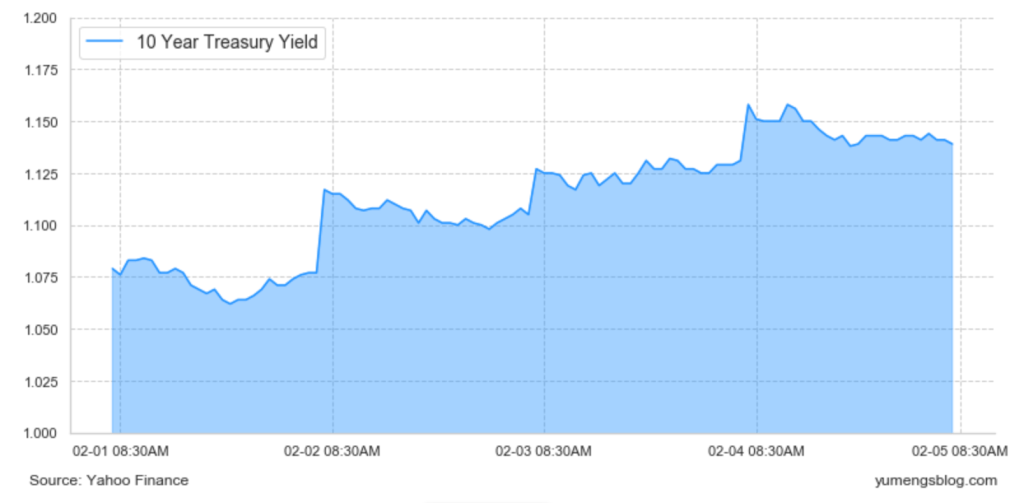

In the week just past, the treasury market went through a meaningful round of consolidation in so far as after 10-year yields backed up to roughly 180. I won’t go that far to interpret the slight bullish drift as any broader tone shift, other than simply to acknowledge that bearish repricing have a tendency to occur in a step function as opposed to simply being a one-way move to a sustainably higher rate plateau. In other words, a 25 basis point sell-off followed by a round of consolidation before attempting to press yields even higher is very consistent with the way that the treasury market has historically traded. Especially given that it’s still very early in the quarter, very early in the year, the idea that all of the bearish positions that are going to be established have been established doesn’t really resonate.

The consensus tightening timeline

And as the year is progressing, we are getting a greater degree of clarity on what path monetary policy normalization will probably end up taking. Governor Waller was out later in the week saying that as a baseline, he still favors three rate hikes in 2022 and Chicago Fed President Evans said the same thing. So from that perspective, at this point, it seems that the consensus tightening timeline is a 25 basis point rate hike in March followed by another 25 basis point move in June. And then a period exactly as Waller said to evaluate what the inflation landscape looks like before delivering balance sheet normalization in September. And then with all the applicable pandemic caveats considered, another rate hike in December.

And while there does seem to be consensus forming around the timing of rate hikes and the balance sheet runoff announcement, there’s a fair amount of divergence in terms of market participants’ expectations for exactly what the balance sheet rundown will look like. The question is whether the caps are achieved immediately for the balance sheet rundown or if they stagger in over time. And if they do stagger in over time, will it be a 10, 12-month period before we reach the maximum runoff velocity or will it be four or six months? Assuming that it will be a four to six-month timeframe would be more acutely focused on the way in which the Treasury Department will choose to fill any funding gap. All else being equal, if the roll off runway is longer, the impact on the Treasury Department’s borrowing needs in 2022 will be much less significant and easily absorbed in the bill market. In the event that we reached the caps in 2022, I think then the Treasury Department has a lot more or weighty decisions to consider in terms of where they increase issuance.

A Close Look at the yoy CPI

When looking at the CPI print, the details were very much in keeping what it is we’ve been seeing throughout the bulk of the pandemic. A large portion of the gains were centered in OER and used auto prices. What I will find fascinating is what would happen when the base effects hit in the second quarter and the year-over-year inflation figures become less headline-grabbing than they have been recently. By then we’ll be at a point where the Fed has already started the rate normalization process. And if we find ourselves an environment where the yearly inflation numbers are moderating somewhat, it will, if nothing else take some of the urgency out of the Fed’s tightening campaign.

What’s quite intriguing was the market’s knee-jerk response to the CPI prints. At a first pass, higher than expected prices should have exacerbated the sell-off that we’ve been seeing. But instead, what we saw was actually a knee-jerk draw up in yields still well above 170 in the 10-year space. One can characterize that as a version of a strong inflation print already being priced in. I would add that headlining core inflation were above consensus, but not so far above consensus as to imply that the market’s expectations for Fed hikes would be insufficient to counter the rise in consumer prices. So what the market is saying is that as long as inflation continues to increase at the pace it has been and doesn’t accelerate even further, the Fed’s 25 basis point a quarter cadence with a balance sheet runoff sometime later this year should be sufficient to keep inflation expectations anchored. And at the end of the day, that’s really the Fed’s primary goal at this moment. That’s also in line with the rising real rates and the fact that breakevens have continued to moderate dropping below 250 over this past week, which has got to be encouraging for monetary policy makers if only because it indicates that the market is showing faith in the Fed’s ability to offset higher inflation.

I would maintain that one of this year’s primary theme will still be the flattening of the curve, particularly 5-30s as pricing in a full tightening cycle results in upward pressure on rates in the front end of the curve, while the ramifications of a less accommodated monetary policy contain how far 10 and 30-year yields are able to back up as the global economy continues to struggle with the coronavirus. And all of the associated implications for both real growth, as well as the implications for a higher inflationary environment at least in the near-term.